Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. Start Free

A Special Purpose Vehicle (SPV) is a separate legal entity created by an organization. The SPV is a distinct company with its own assets and liabilities, as well as its own legal status. Usually, they are created for a specific objective, often to isolate financial risk. As it is a separate legal entity, if the parent company goes bankrupt, the special purpose vehicle can carry on.

A special purpose vehicle can be a “bankruptcy-remote entity” because the operations of the entity are restricted to the purchase and financing of specific assets or projects.

The typical legal forms of special purpose vehicles are partnerships, limited partnerships, or joint ventures. Moreover, in some cases, it is required that the SPV should not be owned by the company on whose behalf the entity is created.

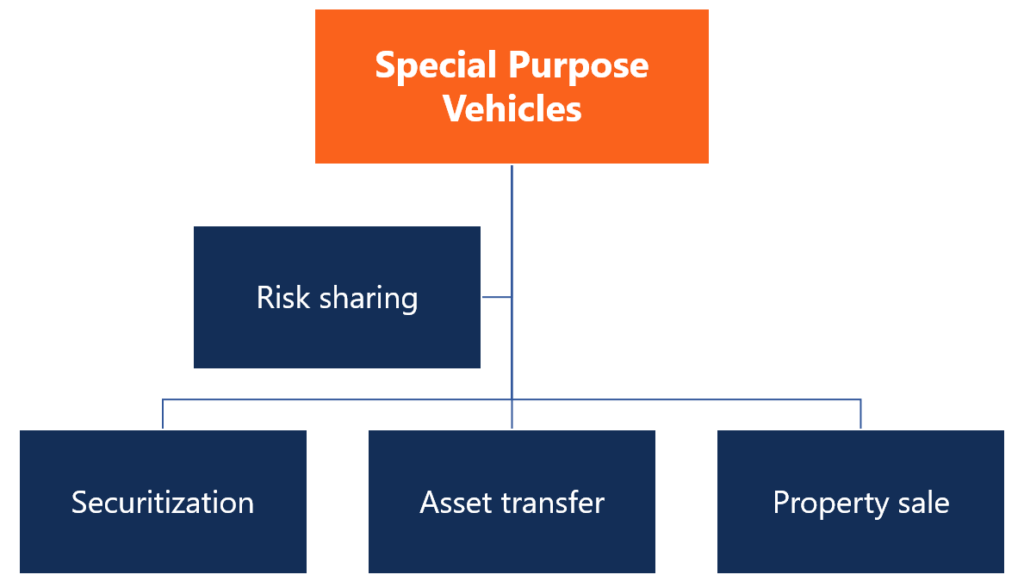

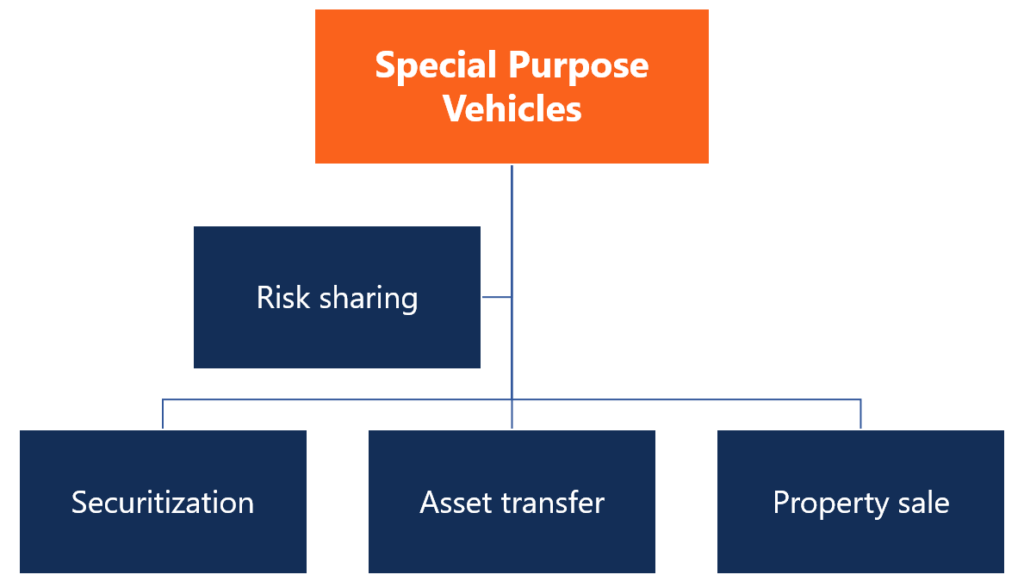

The following are the most common reasons for creating SPVs:

A corporation’s project may entail significant risks. Creating an SPV enables the corporation to legally isolate the risks of the project and then share this risk with other investors.

Securitization of loans is a common reason to create an SPV. For example, when issuing mortgage-backed securities from a pool of mortgages, a bank can separate the loans from its other obligations by creating an SPV. The SPV allows investors in the mortgage-backed securities to receive payments for these loans before other creditors of the bank.

Certain types of assets can be hard to transfer. Thus, a company may create an SPV to own these assets. When they want to transfer the assets, they can simply sell the SPV as part of a merger and acquisition (M&A) process.

If the taxes on property sales are higher than the capital gain realized from the sale, a company may create an SPV that will own the properties for sale. It can then sell the SPV instead of the properties and pay tax on the capital gain from the sale instead of having to pay the property sales tax.

Benefits:

Risks:

Learn more from Wharton about special purpose vehicles and why companies use them.

Thank you for reading CFI’s guide on Special Purpose Vehicle (SPV). To keep learning and advancing your finance career, we highly recommend the additional CFI resources below:

From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.