November 9, 2023

Payroll calendar templates are predesigned forms, spreadsheets, or PDFs that allow business owners to track important dates and deadlines, ensuring employee pay is accurate and on time. Payroll calendars can work with other payroll tools, such as time tracking , to provide a convenient and efficient way to organize and manage pay periods.

By using a payroll calendar template, businesses can avoid errors and miscalculations that may occur when managing pay periods manually. Use the links below to jump to the section that covers your pay period: such as time tracking , scheduling, or invoicing.

Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic.

A weekly payroll calendar template lays out the weekly payroll schedule, which includes 52 weekly pay dates. The pay date is the same day every week—usually Friday.

The weekly payroll calendar template assumes your pay period end date and pay date are the same. It accounts for weekends and holidays as well. For example, if your pay date falls on a weekend or holiday, the pay date is shifted to the earliest business day.

2024 weekly payroll calendar templates:

2025 weekly payroll calendar templates:

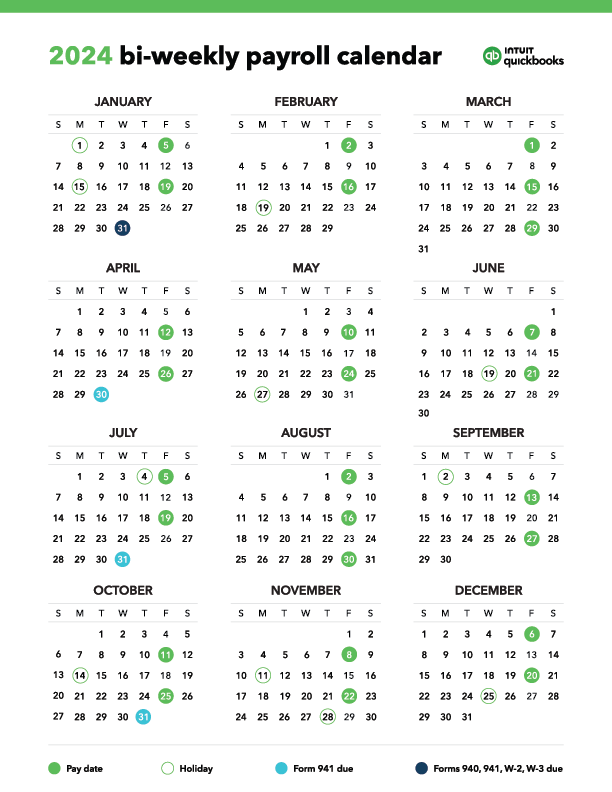

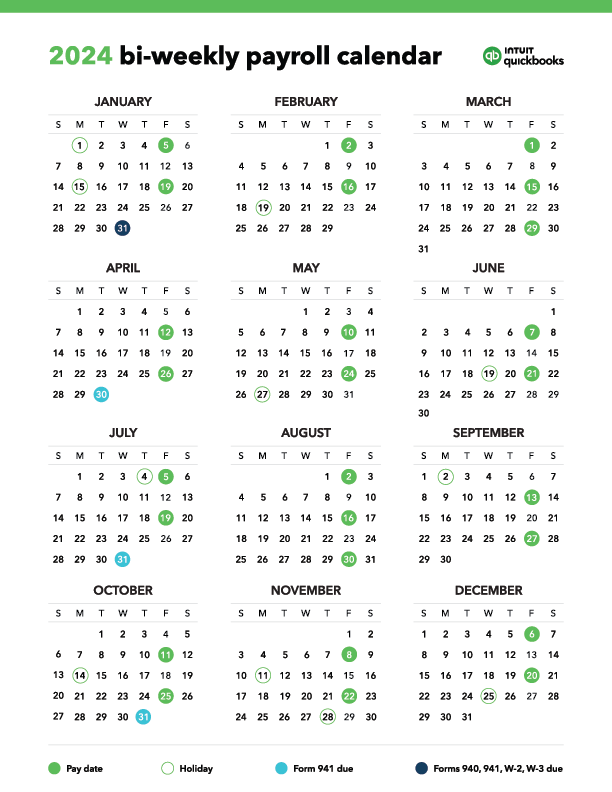

The biweekly payroll calendar template is for businesses with biweekly payroll periods, which include 26 pay periods a year. Biweekly payroll is similar to weekly payroll, except it runs every other week. For example, the pay date will be the same each period, usually Friday, and happens once every 14 days.

This template assumes your pay date is the same as the last day of your pay period. However, if the pay date falls on a weekend or holiday, it’s adjusted to the nearest business day.

2024 biweekly payroll calendar templates:

2025 biweekly payroll calendar templates:

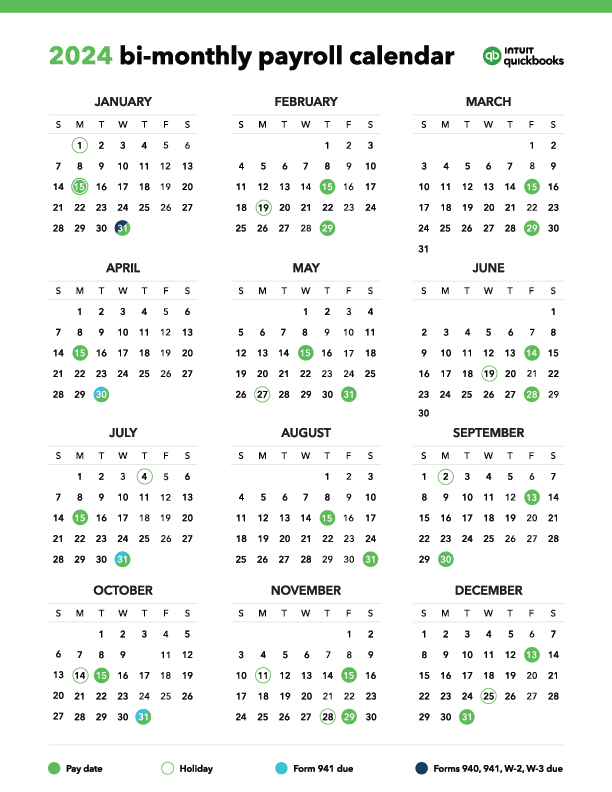

Bimonthly is different from biweekly, where there are 24 pay periods—versus 26 for biweekly. Bimonthly, or semimonthly, payroll happens twice a month, such as on the 15th and last day of the month. Note there can be other variations, such as the 10th and 25th of the month.

Unlike weekly and biweekly payroll, bimonthly is not on a set day of the week, such as Friday. Instead. Bimonthly payroll may fall on a different weekday each period. Bimonthly payroll is a popular choice for businesses, as it balances pay frequency and administration work.

Like the weekly and biweekly templates, the payroll template for bimonthly accounts for holidays and weekends. Thus, if a pay date falls on either of those, the pay date is moved up to the soonest business day.

2024 bimonthly payroll calendar templates:

2025 bimonthly payroll calendar templates

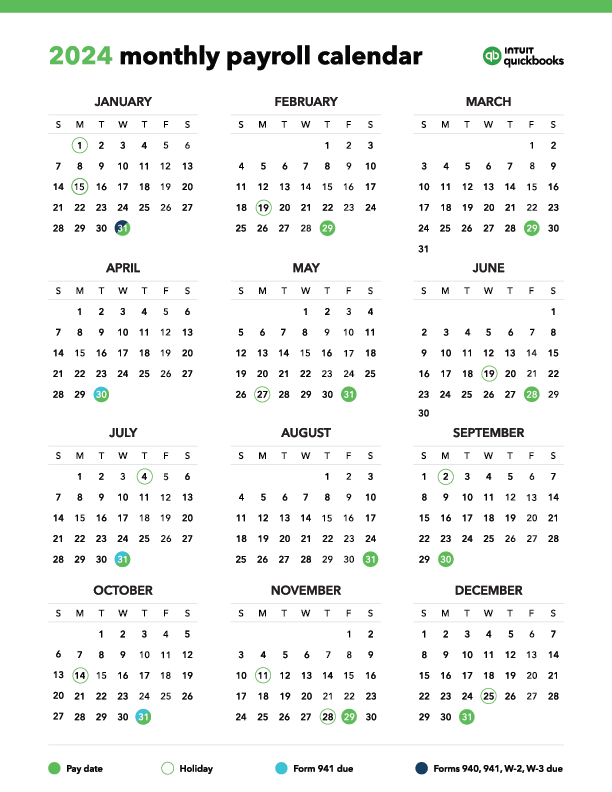

A monthly payroll calendar template works for businesses paying employees monthly—which is 12 pay periods a year. The payroll calendar template accounts for 12 payroll periods, with the pay date occurring on the first of every month. However, like bimonthly, the day of the week that is the pay date can vary.

The payroll template for monthly payroll is adjusted so that the pay date—if it falls on a weekend or holiday—will instead be the soonest business day. Monthly payroll has the least administrative work, so some businesses will opt for it to keep payroll costs low.

2024 monthly payroll calendar templates

2025 monthly payroll calendar templates

Keeping accurate payroll records is essential for you and your employees. Employees need payroll records to file taxes or apply for a mortgage or car loan, while employers need them to comply with state and government regulations. Plus, it helps to have accurate payroll information for things like hiring and managing cash flow .

Here are some best practices to ensure your payroll records are always up-to-date and accurate:

Managing and organizing payroll is a challenging task for any small business owner. But with the right tools, you may find keeping accurate payroll records is as simple as it is rewarding.

Payroll calendar templates are a valuable resource for business owners and payroll departments. They provide structure and organization in managing pay periods, whether you’re seasoned or just figuring out how to set up payroll .

And while a template can help you with organization, they can’t actually run payroll. Payroll solutions like QuickBooks Payroll can help you stay ahead of payroll tax deadlines, run payroll reports, and pay employees through direct deposit.

There is no magic formula to determine whether a worker is an independent contractor or an employee. but the IRS offers some guidance. Three categories determine the degree of control you have over a worker:

As a business owner, it’s up to you to determine whether a worker is an employee or an independent contractor. Be sure to check in with your state, since each has its own rules and regulations pertaining to worker classifications.

What is the best payroll for hourly employees?The best payroll schedule for hourly employees is usually a weekly or biweekly pay schedule. It allows employers to accurately calculate pay based on the number of hours worked during that specific pay period. By paying employees weekly or biweekly, employers can ensure timely and consistent paychecks for their hourly workers.

How many pay periods are there in each month for biweekly payroll?The best payroll schedule for hourly employees is usually a weekly or biweekly pay schedule. It allows employers to accurately calculate pay based on the number of hours worked during that specific pay period. By paying employees weekly or biweekly, employers can ensure timely and consistent paychecks for their hourly workers.

Why do some biweekly payroll calendars have 27 pay periods?The best payroll schedule for hourly employees is usually a weekly or biweekly pay schedule. It allows employers to accurately calculate pay based on the number of hours worked during that specific pay period. By paying employees weekly or biweekly, employers can ensure timely and consistent paychecks for their hourly workers.

How do you calculate paychecks for each pay period?The best payroll schedule for hourly employees is usually a weekly or biweekly pay schedule. It allows employers to accurately calculate pay based on the number of hours worked during that specific pay period. By paying employees weekly or biweekly, employers can ensure timely and consistent paychecks for their hourly workers.

QuickBooks Online Payroll & Contractor Payments:Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Marshall Hargrave

Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor's degree in finance from Appalachian State University.

December 9, 2020

Important pricing details and product informationMoney movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.